Primis – Branding Overview

Primis is a branding concept for a debit card/finance app made specifically for children ages 7–11. The goal was to create a brand that helps kids learn financial responsibility in a way that feels simple, safe, and approachable for both children and their parents.

Why This Matters: The Financial Learning Gap

For the Kids:

The Digital Blur: Kids can't see or touch digital money, making the connection between value and spending hard to bridge together. They want to learn but need friendly guidance and real-life connections to bring money to life!

For the Parents:

The Balancing Act: Parents want their kids to be financially smart and safe, but without micro managing.

An Opportunity to Make a Difference

I wanted to create a simple, joyful, and genuinely kid-friendly financial experience that empowers children to learn by doing, and gives parents the peace of mind they need to cheer them on.

Research Insights

While exploring how families teach kids about money, I spent time reading real conversations across communities like r/Parenting and r/PersonalFinance. Parents consistently shared that they want their kids to grow up confident with money, but many feel unsure how to teach those skills, especially now that so much spending happens digitally instead of with physical cash.

A pattern that stood out was how much harder digital money is for kids to understand. Without being able to see it, hold it, or watch it leave their hands, the value becomes abstract. Several parents mentioned that their kids did not fully grasp money until they had something visual and hands-on to manage. Kids stayed motivated only when money felt real, connected to their choices, and tied to goals they cared about.

I was also struck by how many parents expressed a quiet sense of guilt. They wanted to help their kids build strong financial habits but felt overwhelmed, unsure, or worried they were not doing enough. At the same time, kids were eager to learn. They simply needed clarity, control, and a way to make progress visible.

Across these stories, families were searching for something simple and supportive. They wanted a tool that does more than track numbers. They wanted something that teaches, guides, and grows with their kids, while still giving parents visibility without constant micromanaging.

These insights revealed a clear opportunity to design a product that makes financial learning intuitive, empowering, and genuinely meaningful for both kids and parents.

The Solution

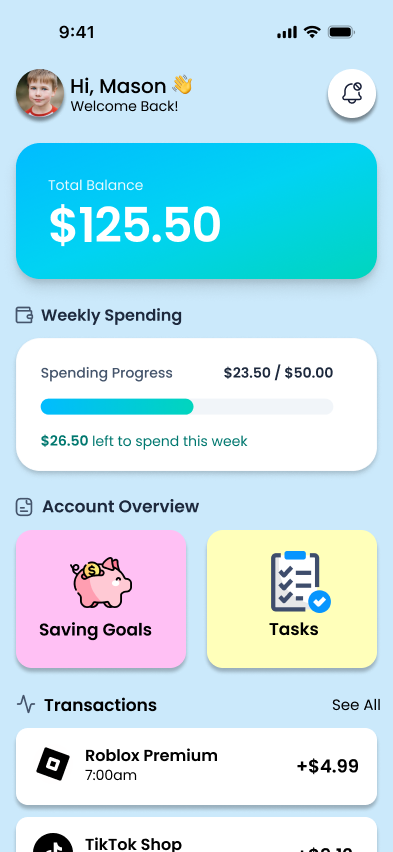

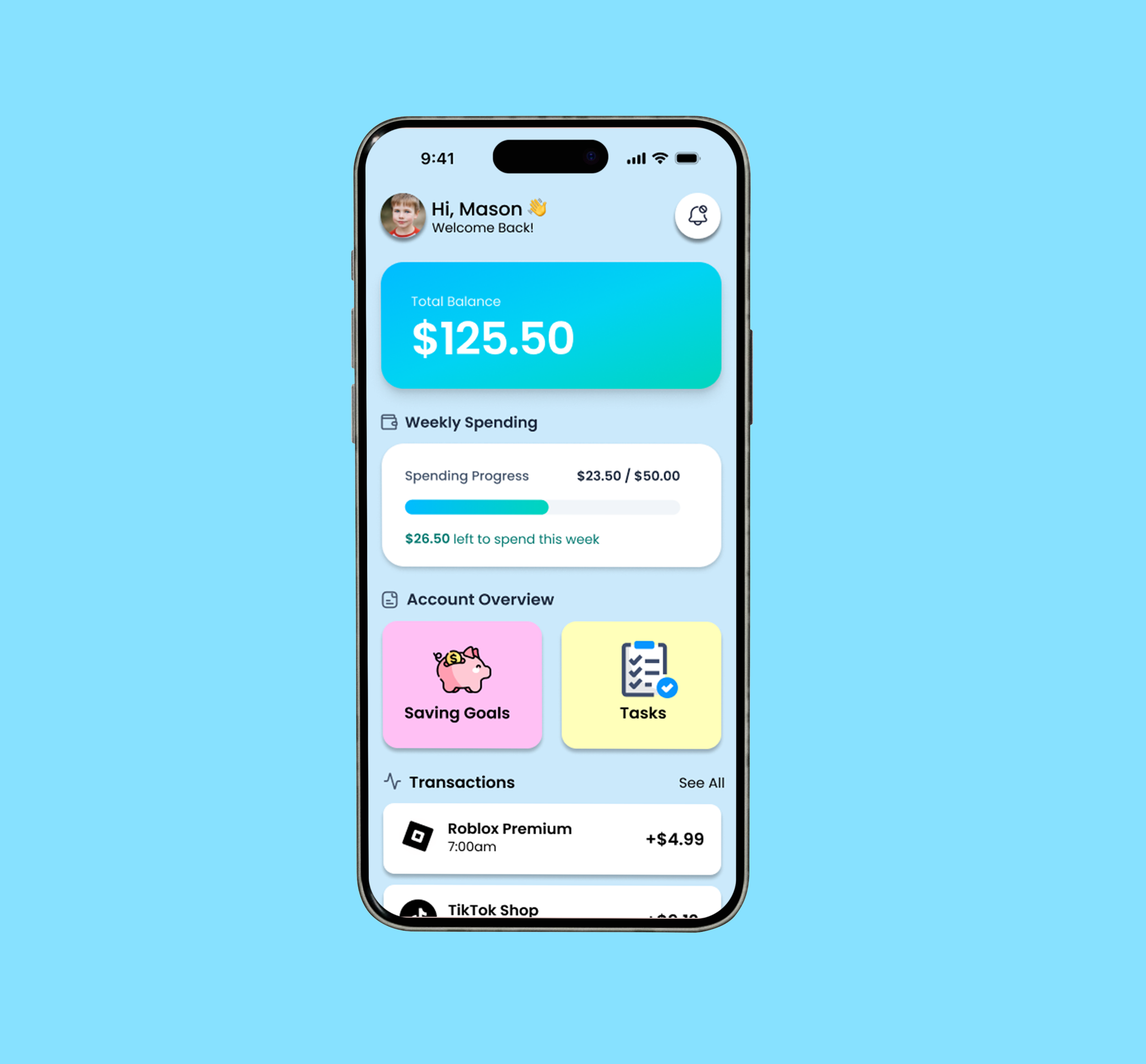

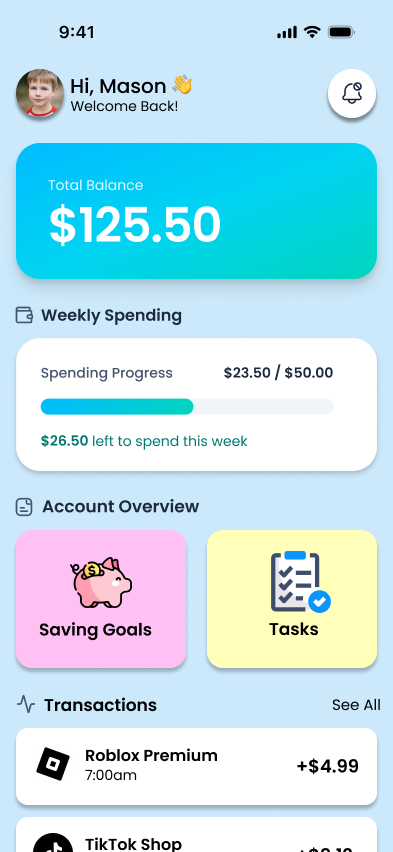

Clear Money Awareness

Large balance card makes money easy to understand.

Simple language (“Total Balance,” “This Week”) builds familiarity with banking terms.

Budgeting Made Simple

Weekly spending bar teaches kids how much they’ve used and what’s left.

Visual progress reinforces responsible spending.

Encouraging Saving Habits

Dedicated “Saving Goals” tile helps kids set goals and track progress.

Progress bars motivate long-term thinking and delayed gratification.

Learning to Earn

“Tasks” section shows kids how money is earned through responsibilities.

Clear task → completion → allowance flow builds real-world earning habits.

Real Transaction Experience

Transaction list introduces income vs. spending in a simple, kid-friendly format.

Helps kids understand where their money goes.

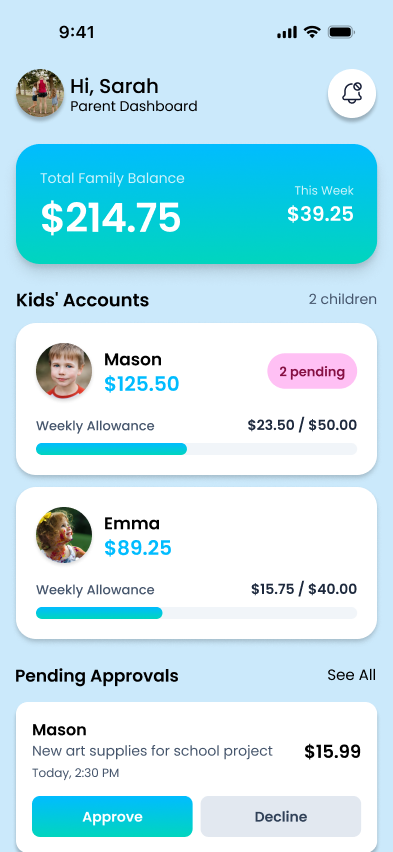

Parental Guidance & Safety

Parents get a dashboard to monitor balances, allowances, and requests.

Approval features teach kids to ask for permission before making purchases.

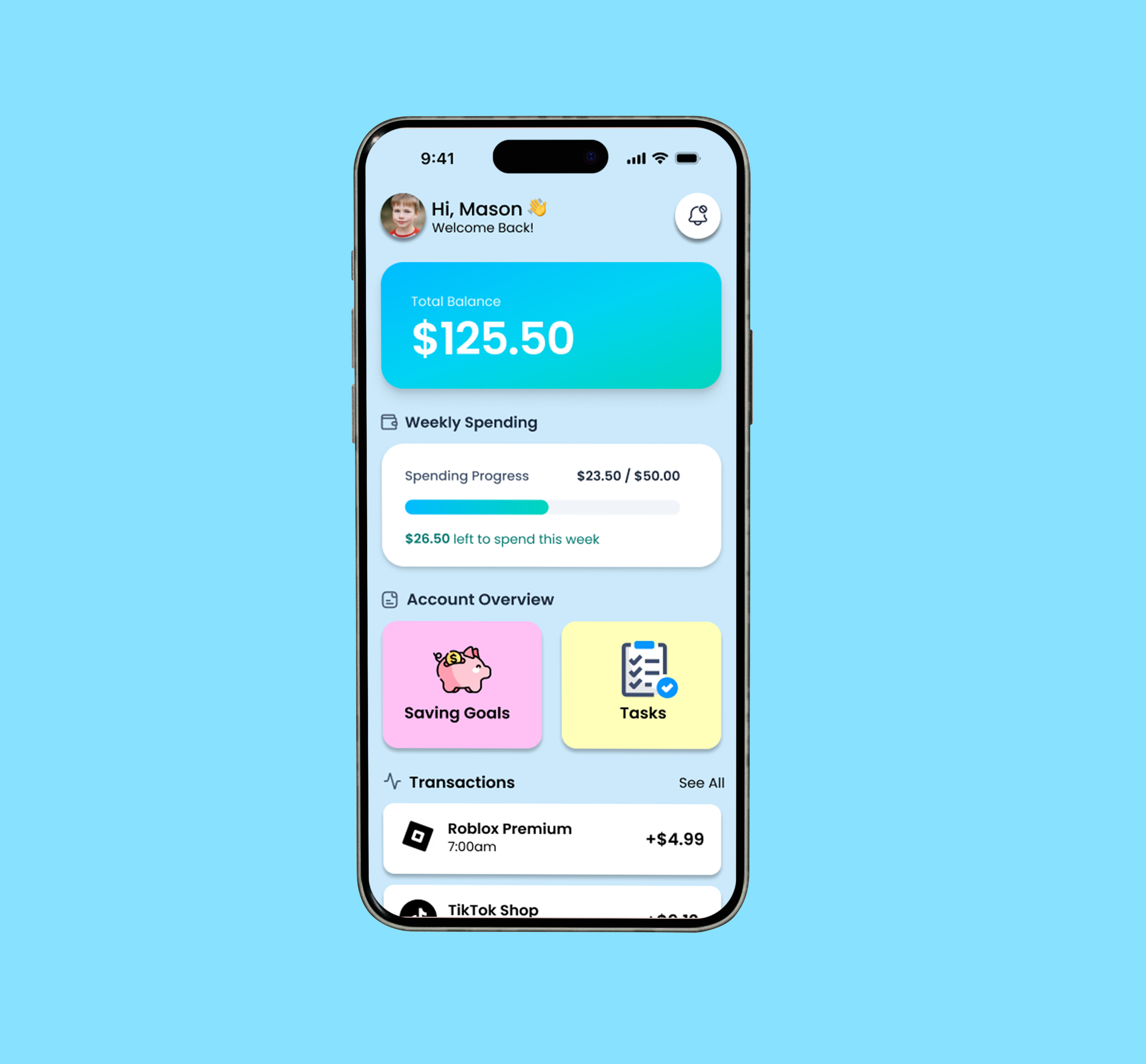

Confidence Through Friendly Design

Warm visuals, large tap targets, and friendly greetings keep kids engaged.

Makes learning about money feel fun, not intimidating.

Success Metrics

As a theoretical project, these metrics highlight how I would measure impact if this were a live product. This is also where I’m glad I have experience working in programmatic, because I’m able to think not just about design, but also about how performance, engagement, and optimization tie together.

What I Would Measure:

Onboarding completion

I want to see if families can easily create an account and set their first savings goal without running into friction.

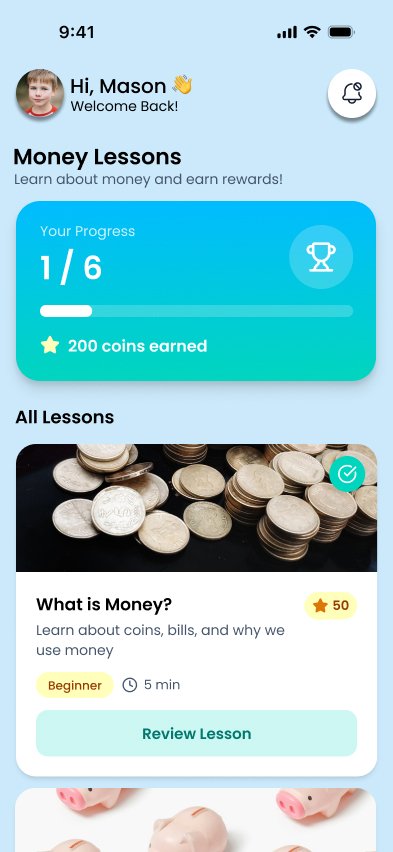

Feature engagement

I’d look at what kids naturally interact with most, whether it’s Savings, Request Money, or Learning.

Learning/Tasks progress

I’d track how often kids complete lessons and whether they return to them, since that shows real understanding is forming.

Parent involvement

I’d monitor how often parents review activity or approve requests to see if the app is actually supporting them, not overwhelming them.

Savings goal momentum

I’d watch how often goals are created and completed to understand whether healthy habits are sticking.

Impact of gamification

I’d measure whether badges and milestones actually motivate kids or just sit in the background.

Family retention

I’d look at whether families keep coming back over time to understand the long-term value of the experience.